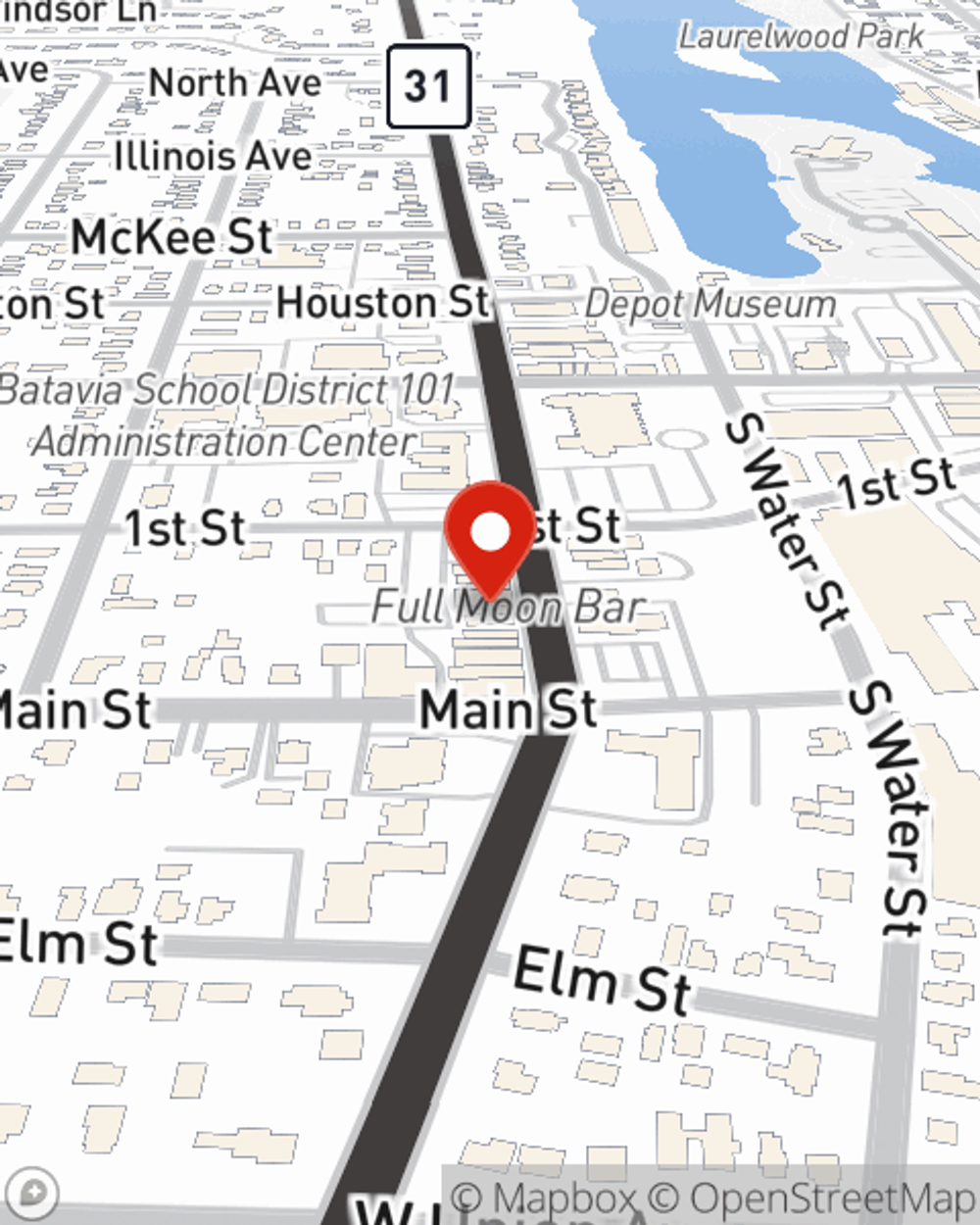

Business Insurance in and around Batavia

Looking for small business insurance coverage?

Cover all the bases for your small business

State Farm Understands Small Businesses.

You've put a lot of blood, sweat, and tears into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a home cleaning service, a fabric store, a photography business, or other.

Looking for small business insurance coverage?

Cover all the bases for your small business

Get Down To Business With State Farm

Your business thrives off your creativity commitment, and having outstanding coverage with State Farm. While you do what you love and put in the work, let State Farm do their part in supporting you with commercial auto policies, commercial liability umbrella policies and business owners policies.

The right coverages can help keep your business safe. Consider stopping by State Farm agent Scott Queen's office today to discover your options and get started!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Scott Queen

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.